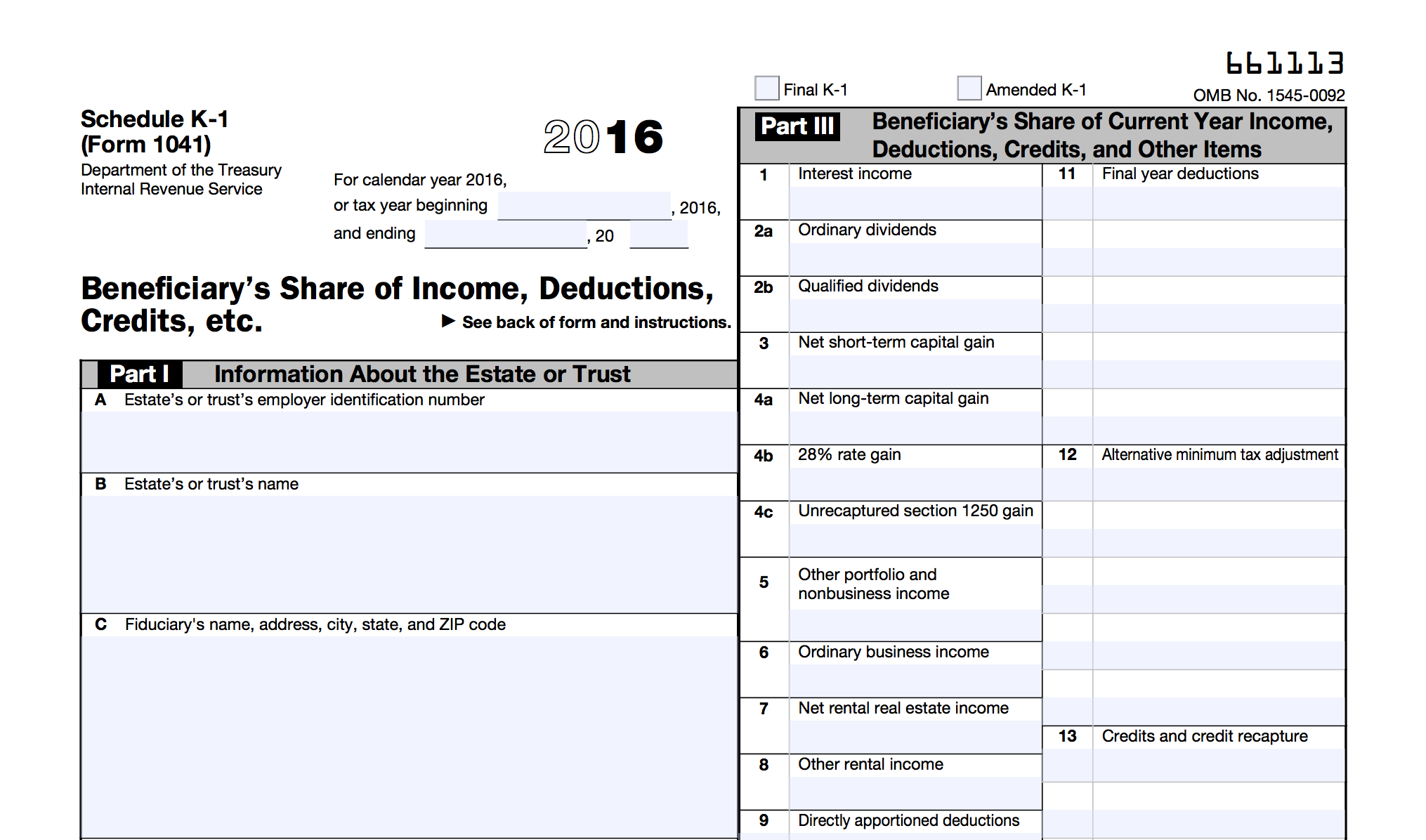

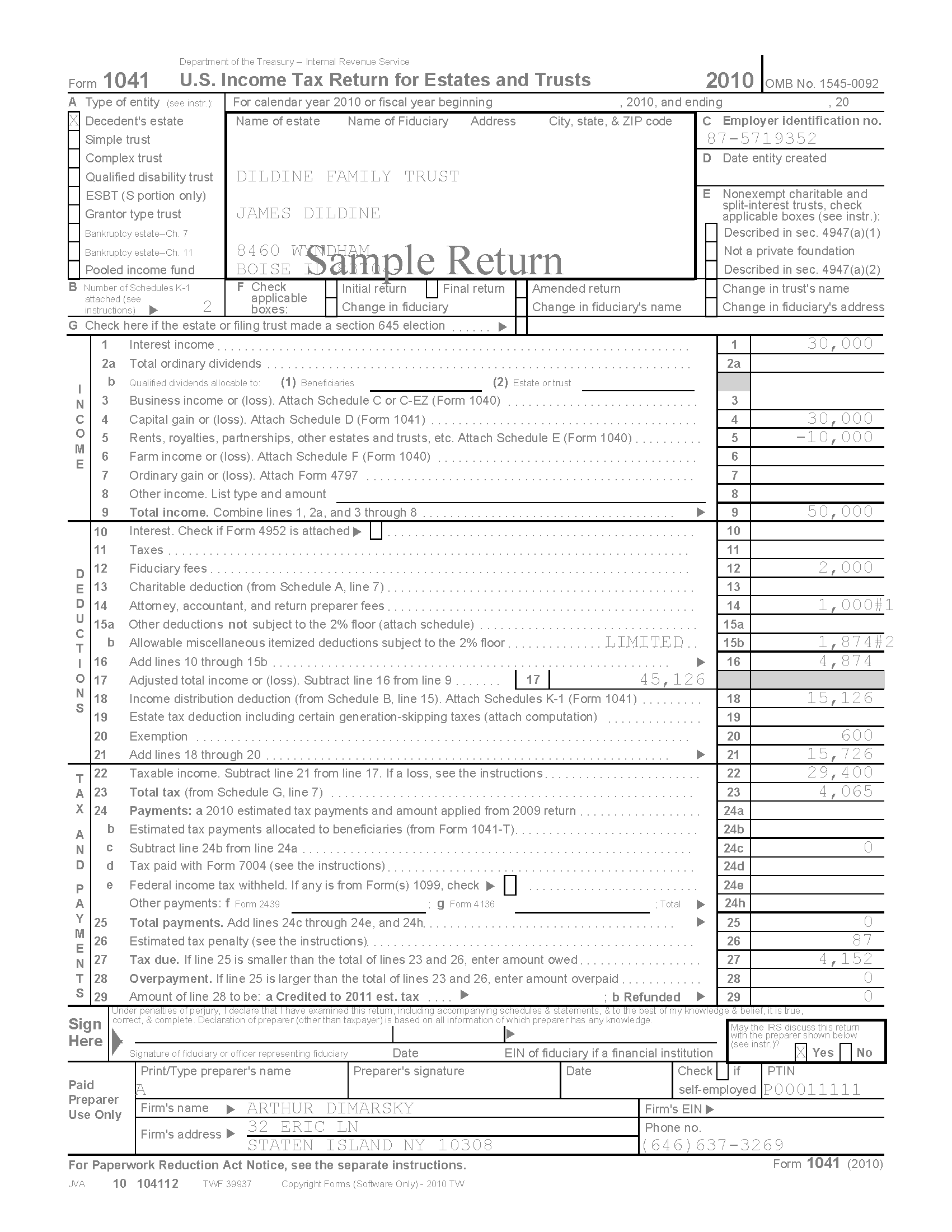

You should generally expect to receive a Schedule K-1 from sponsors that shows your allocable share of any income and/or loss items earned by real estate partnership. Will I still receive a K-1 even if I haven’t received a distribution yet and there is no income to report? You should also expect to receive a state K-1 for the state that the property of the real estate investment is located in, unless the investment is held in a state that does not assess state income tax (refer to the article Do I need to file out-of-state tax returns and why?).Īdditionally, if you transferred your investment from one entity to another during the year, you should expect to receive a K-1 for each entity that at any point held the investment. Investors that have invested in more than one deal on the Marketplace will receive a separate federal Schedule K-1 for each investment. Understanding Your Schedule K-1 and Real Estate Taxes, Part IIĪn investor will receive a single federal Schedule K-1 for its investment in any Marketplace deal.Understanding Your Schedule K-1 and Real Estate Taxes.You should consult with a tax professional on your particular situation. Please keep in mind CrowdStreet does not offer tax advice. To learn more about taxes relating to commercial real estate, the real estate Schedule K-1, and if items such as depreciation will be included on the K-1, please visit the following articles in the CrowdStreet resource library below. Investors who are invested in an LLC taxed as a partnership will receive a Schedule K-1, while REITs (real estate investment trusts) will issue a 1099 to show your taxable interest and/or dividends. Your K-1 will be issued to you from the sponsor of the deal that you are invested in. As such, the taxable activity earned by the partnership is allocated to all of the individual members (partners) based on ownership percentage and is reported to the investors through the K-1. If you are an investor in a CrowdStreet Marketplace deal, you generally hold membership interest in a real estate LLC (limited liability company) treated as a partnership for tax purposes.

The K-1 will report your share of any taxable items for the calendar year for investments that you hold membership interest in.

The Schedule K-1 is a standard IRS form that is issued annually to report activity from investments in partnership interests.

K-1 overview What Is a K-1? Should I expect to receive a K-1 or a 1099?

0 kommentar(er)

0 kommentar(er)